Application for Earnest Money Deposit (EMD)

We can quickly provide Earnest Money Deposits, allowing you to show good faith in buying your next investment property.

Using our funds helps you preserve cash flow and scale your investments—wholesalers can put more properties under contract than ever before. Contact us to learn how this can help you increase your profits.

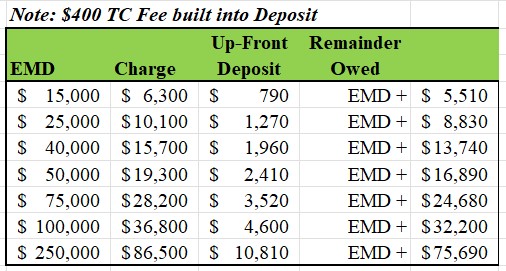

To ensure quality service and sustainable operations, we require a 5% commitment deposit on the EMD before funding. This deposit demonstrates your serious intent and is fully credited toward our return on investment (ROI) at closing. By securing this commitment, we align interests, streamline transactions, and provide a reliable funding process that benefits all parties.

Each purchase agreement varies, but based on the level of risk, we are typically prepared to fund EMDs under the following terms. These terms assume that contingencies remain in place or that matching funds covering our EMD and ROI are held in escrow before the EMD becomes non-refundable.

Upfront Deposit

An initial payment is due prior to funding the EMD. This payment is a deposit that will be credited toward our return on investment (ROI) at the backend of the deal. It is not an additional fee.

EMD Funding

We understand that deals can sometimes take longer than expected, and we want to support your success. For this reason, we’ve included a grace period from Day 30 to Day 45, during which no additional payment is required.

15-Day Extension Payments (Starting Day 45)

If additional time is needed, optional 15-day extensions are available. To reduce immediate financial pressure, only a portion is due in advance, with any remaining balance collected at closing.

Final Payment at Closing

At closing, we will collect:

The EMD (return of principal).

The remaining ROI above the deposit, completing the total ROI.

Any remaining unpaid balances from 15-day extensions.